Starting your own business is a thrilling experience. Whether you’re starting a small ecommerce business or preparing to conquer the world with a massive conglomerate, there are few things more exciting than being your boss.

Before you can begin your entrepreneurial pursuits, you must first register your firm in the United Kingdom. While there is a lot to do to ensure that you can operate lawfully in the country, there is no need to worry.

From determining whether you need to register your corporation to submitting your paperwork to the appropriate authorities, this 6-step tutorial will help you register your business in the UK correctly.

Do I Need to Register My UK Business?

The scope and magnitude of your firm will determine whether you must register the entity. If you are self-employed and earn more than £1,000 per year, you must register with HMRC as a sole trader. If your annual profits exceed £30,000, you must register as a limited company. We’ll look more closely at both of these legal systems below.

All UK citizens are eligible to register a business in the country. Citizens from other nations, even if they do not live in the UK, can register a business there. The sole criterion is that you have an office address registered in the UK. This could be a friend’s or family member’s address, or even a virtual office location.

Do I Need to Register My Online Business in the UK?

Online businesses must follow the same rules as brick-and-mortar enterprises, so registration is required.

Of course, an online firm can serve customers all over the world. Setting up an ecommerce business in the UK does not limit where you can offer your goods and services, but you should ensure that you have procedures in place to accept global payments.

6 Steps to Registering a Business in the UK

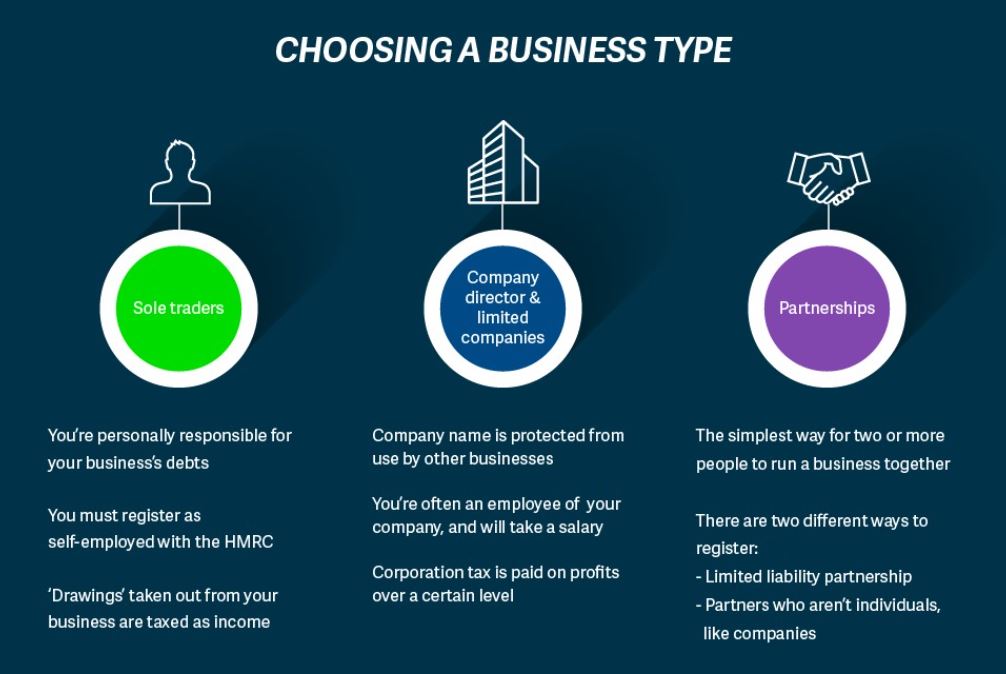

1. Choose Your Company Type

The first stage in the registration procedure is to determine the sort of entity you want to form. Following that, you will need to register your company with either HMRC or Companies House.

When you register in the UK, you have the option of selecting one of several alternative business structures. The best option for you will be determined by your industry if you intend to hire staff, how much turnover you anticipate, and other operational variables.

Let’s take a deeper look at the various legal frameworks available.

Limited Company

Limited companies in the UK must register with Companies House and include the suffix “Ltd” or the phrase “Limited” at the end of their name. These firms must also file for corporation tax within three months of registering with Companies House.

Limited Companies are legally different from the individuals who operate them. This means that if the firm fails, your assets cannot be utilized to pay off debts or other responsibilities.

These entities are either limited by shares or by a guarantee. Limited by shares indicates that it is a for-profit corporation that is legally distinct from its owners. The corporation has shares and shareholders, and it can retain its income after paying taxes.

A business limited by guarantee, on the other hand, is more often referred to as a non-profit organization. This form of company is similarly legally independent from its owners, but instead of shareholders, it has guarantors, and any profits earned are returned to the business.

In the UK, limited businesses are classified into two types:

- Private limited company (Ltd.): A private limited company is registered with Companies House and requires at least one director and one shareholder. It is an independent legal entity with its assets, income, and liabilities. Company shares are not publicly traded, and there is no minimum investment required to become a shareholder. Each shareholder’s responsibility is restricted to their proportionate ownership of the corporation.

- Public limited company (PLC): Most businesses begin as private limited corporations and may eventually become public limited companies after seeing some growth. A public limited company, like a private limited company, has directors and shareholders; however, the shares can be publicly traded. This allows the company to raise financing more readily. However, it also entails more complex tax and financial reporting requirements. To become a public limited company, the corporation must have issued shares valued at least £50,000 to the public.

Partnership

In a partnership, two or more people collaborate to form a business. The partners share the company’s profits and dividends, but they are also equally responsible for any debts or losses, as well as national insurance.

Many small enterprises are run in this fashion, falling into one of the following categories:

- General partnership: In a general partnership, all profits and liabilities are distributed equally among the partners. General partnerships must register with the HMRC. One partner is chosen as the nominated partner and is in charge of filing the company’s taxes. Each of the partners must also file their tax returns.

- Limited partnership: In a limited partnership, one (or more) general partners are both accountable for day-to-day operations and liable for the company’s losses or debts. In addition, the partnership contains one or more limited partners that give financial support but do not participate in firm management. Limited partners are only personally accountable for the money they invested in the company.

- Limited liability partnership (LLP): If none of the partners wish to be personally liable for company obligations, an LLP may be the way to go. This type of partnership requires each member to pay income taxes on their portion of the company’s profits, but they are not personally liable for debts. Unlike other types of partnerships, an LLP must have a formal agreement in place and be registered with Companies House.

Sole Trader

The most basic sort of business is a sole trader. You and your business are not legally distinct.

A sole trader is not obliged to register their firm with Companies House, but they must register with HMRC for self-assessment tax returns to ensure they pay income tax and national insurance.

As a sole trader, you have the option of operating your firm under your name or a company name. Sole trader company names cannot include the words “limited, Ltd, limited liability partnership, LLP, public limited company, or PLC”. They must also not be offensive (e.g., use curse words), contain sensitive words (e.g., bank or accredited), or imply a link to any government authority.

You would need to verify local databases to ensure that the name you chose is not already trademarked or being used by another firm.

Overseas Company

If you already own and manage a company in another country and want to establish a physical branch in the United Kingdom, you can register with Companies House as an overseas company. All you have to do is fill out a simple form and send it to Companies House, along with a £20 charge.

Summary Table: Legal Structures for UK Businesses

|

Type of Business |

Registration Requirements |

Taxation |

| Limited Company | ||

|

Private Limited Company |

Register with Companies House |

Corporation Tax Companies submit their own taxes, and shareholders/directors’ responsibility is limited to their portion. |

|

Public Limited Company |

Register with Companies House |

Corporation Tax: Publicly traded stocks and more complex tax reporting |

| Partnership | ||

|

General Partnership |

Register with HMRC |

Partners pay income taxes on their share of profits. Register for VAT. |

|

Limited Partnership |

Register with HMRC | Partners pay income taxes on their share of profits. Register for VAT. |

| Limited Liability Partnership | Register with Companies House |

Partners pay income taxes on their share of profits. Register for VAT. |

| Sole Trader | ||

|

Register with HMRC |

Pay national insurance and income tax | |

|

Register for VAT |

||

| Overseas Company | ||

|

Register with Companies House |

Corporation Tax |

|

2. Register a UK Business Name

When forming a Limited Company or LLP, the following step is to register the business name with Companies House.

Before proceeding, you must ensure that the name you wish to use is not already taken. You can use the Companies House company name availability checker to look for the name. If it isn’t already taken, it’s a good idea to trademark it so no one else can use it.

When selecting a business name, there are several factors to consider, including making sure it is unique and memorable, as well as aligning with your sector and messaging.

From a legal aspect, you must ensure that your business name does not infringe any of the following rules.

- Same as: If you check Companies House and find that your recommended name is the same as another registered company, it indicates either the exact same name is in use or there are only minor differences, such as using a “+” or “&” sign instead of the word “and.” In either case, you will be unable to register this business name unless you have formal permission from the firm that is already using it.

- Too like: A company name that is extremely close to an already established firm will be refused. HMRC provides examples of “Easy Electrics For You Ltd” and “EZ Electrix 4U Ltd.” Despite the varied spellings, the names are too close, and the business that registers first will be allowed permission to use the name.

- Offensive language: Most individuals are hesitant to choose a business name that contains a curse word, or racial or religious slur. If you want to use humor in your company name, be sure it’s appropriate. If you cross the line into mature or offensive humor, your name will most likely be rejected.

- Sensitive words: The UK government has a list of sensitive words that you must obtain authorization to use in your business name. For example, if you wish to put “insurance” in the name, you must obtain authorization from the Financial Conduct Authority. Words that refer to the royal family, such as His or Her Majesty, Prince, Queen, and Windsor, also require specific clearance.

- Other regulated words: Along with sensitive words, there is a list of regulated words. If you intend to use any of these terms or phrases in your company name, you must additionally obtain authorization from specific professional groups. For example, to use the terms “Olympic” or “Olympian,” you must obtain permission from the British Olympic Association.

3. Select an Official Address for Your Business

Every firm in the United Kingdom is required to have an official corporate address that is made public. You can specify whether this will be your home address, an office, or another location.

The address must be a physical location (not a post office box) where documents may be delivered and confirmed as received. However, it does not have to be the address of the actual site from which you operate your business.

For example, if you plan to work from home but don’t want to make your home address public, you can simply find an accountant or other professional who gives the use of their business addresses for a fee.

4. Memorandum and Articles of Association

Most businesses registered in the United Kingdom must have two documents: a memorandum of association (MOA) and articles of association. Before registering a business in the UK, the company director(s) and shareholder(s) must sign these documents.

When you register your business online, you will receive a MOA automatically. It must be signed by the original shareholders and directors to express their agreement to establish the business. Once registered, this memorandum cannot be altered or changed.

The AOA is essentially the company’s operational policies as established by the directors, shareholders, and secretaries (if one exists). When registering your entity, you can create your articles or use an online template and mail the document to Companies House.

5. Get Your SIC Code

As part of the UK business registration process, you must also obtain your Standard Industrial Classification of Economic Activities (SIC) code.

These codes are used to categorize businesses by industry and serve as the foundation for collecting and reporting statistical data on a variety of industries. The purpose is to assist Companies House in identifying the type of business you operate.

6. Register Your UK Business Bank Account

If you register your firm as a limited company, you must open a business bank account.

To accomplish this, you will need to furnish the bank with the following:

- All directors and partners must provide identification documents (such as a national ID card, biometric residency permit, or passport).

- Proof of Address for Your Business

- The companies House registration number

- the estimated annual turnover for the business.

Although a director or shareholder in your company does not have to be a UK resident to register a business in the UK, opening a bank account may be problematic if no one associated with the business is a UK resident. If this is the case, you can discuss it with your bank.

Unlike limited corporations, partnerships, and sole traders are not required by law to open a business bank account. If you’re just getting started, you might want to look at other choices for managing your entity’s finances.

How Much Does it Cost to Set Up a Business in the United Kingdom?

Registering a business in the United Kingdom is relatively affordable. Online registration costs £12 and can take up to 24 hours. For an extra £100, you can get the registration completed the same day.

If you prefer to work with printed documents, you can send them via post. The registration will cost you £40 and take up to 8-10 days to complete.

You can also employ a variety of formation agencies to complete the registration process for you for an extra price.

Conclusion

Registering a small business in the UK involves navigating through various legal requirements and administrative procedures. It’s essential to carefully consider the business structure, whether it’s a sole proprietorship, partnership, or limited company, and understand the associated tax implications and liability protections. Additionally, ensuring compliance with relevant regulations and obtaining necessary permits and licenses are crucial steps in establishing a legitimate and thriving enterprise. Seeking professional advice and utilizing online resources provided by government agencies can streamline the registration process and set the foundation for long-term success. Ultimately, thorough planning and attention to detail are key to successfully registering a small business in the UK and positioning it for growth in the competitive marketplace.

FAQs

What are the basic steps to register a small business in the UK?

The process typically involves choosing a business structure, registering with HM Revenue and Customs (HMRC), deciding on a business name, setting up business bank accounts, and registering for taxes like VAT if applicable.

What are the different business structures available for registration in the UK?

Sole trader, partnership, limited liability partnership (LLP), and limited company are some of the most common business structures. Each structure has unique legal, financial, and tax concerns.

Do I need a business address to register a small business in the UK?

Yes, you must provide a registered business address when registering your small business. This address will be publicly available and can be your home address, a rented office space, or a virtual office address.

What taxes do I need to register for when starting a small business in the UK?

Depending on your business activities, you may need to register for taxes such as Income Tax, Corporation Tax, Value Added Tax (VAT), and National Insurance contributions. It’s essential to understand your tax obligations and register with HMRC accordingly.

How long does it take to register a small business in the UK?

The registration process can vary depending on the business structure chosen and how quickly you provide the required information. It typically takes a few days to several weeks to complete all the necessary registrations and receive confirmation from relevant authorities.